Construction Spending Update 5-2-22 « Construction Analytics

[ad_1]

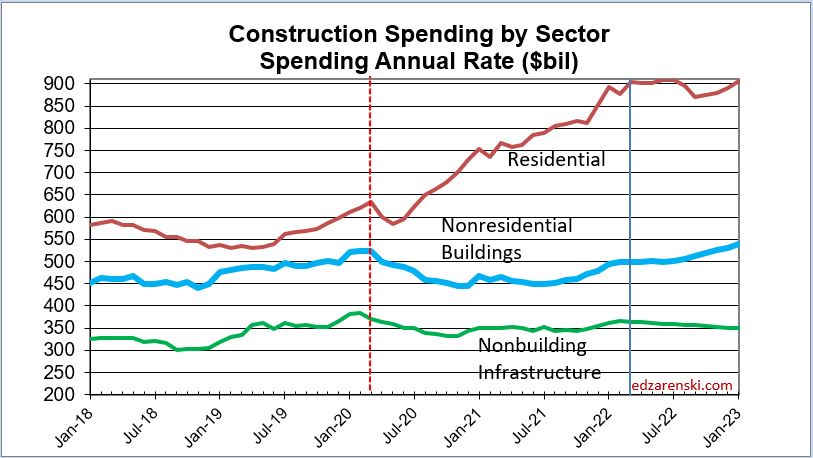

Design Paying out is up +12% year-to-date for the 1st a few months of 2022, all over again mainly driven by residential which is up 18.6% ytd. Whole shelling out is up 11.7% yr about calendar year (Mar’22 vs Mar’21).

Total design paying out for the 1st quarter 2022 vs the 4th quarter 2021 is up +6.5%. I anticipate this amount of paying out progress to flatten about the up coming six months.

Household is about fifty percent of all development paying out. For the previous 6 months, household building starts off ($ by Dodge) posted the highest 6mo total at any time recorded. Dec, Jan and Mar are all near Feb, the maximum month-to-month overall on record. This indicates no slowdown in household shelling out at minimum for the subsequent 6 months while I anticipate by yr stop, residential (annual price of) paying out will be down about 2%.

Investing up yr-to-day: Manufacturing up 34%, Business/Retail up 18% and Highway up 9%.

Paying down 12 months-to-date: Community Safety (80% of Other) -31%, Lodging -27%.

Now 2 yrs considering that the onset of the pandemic, whole building investing in March 2022 is up 15%. Household paying out is 42% higher than March 2020, Nonresidential Bldgs is down 5%, Nonbuilding Infrastructure is down 6%.

Why is shelling out coming in properly above any forecast well prepared at the beginning of the year? Due to the fact Oct, new commences have occur in considerably much better than predicted, 8% greater than the earlier large 6mo period which straight away preceded. But some markets elevated way over typical, residential and manufacturing. This most modern 6 month interval for nonresidential properties includes two months in which commences arrived in 30% bigger than typical. You cannot forecast that. Residential development commences posted the best 6 thirty day period full ever recorded and Q1 2022 is the optimum quarter ever.

Building structures cost inflation over the previous 4 yrs is up 25%. Labor value is two areas, wages up 15% & productivity down 7%, for a net price tag up 22%.

Labor is 35% of full creating charge so 35% of price tag that is up 22% = labor is 8% of that full 25% creating charge inflation. As a result, thoroughly 1/3 of construction inflation about past 4 several years went into personnel pockets.

Just take out inflation and we get development quantity. In 2 yrs considering the fact that the onset of the pandemic total development quantity (paying out minus inflation) is down 5.5%. Residential design volume is up 10%. Nonresidential Bldgs quantity is down 17% Nonbuilding Infrastructure volume is down 15%.

Volume, not paying out, supports jobs. If volume is down, help for jobs drops. If work opportunities boost while quantity declines, then productiveness drops and labor price inflation boosts.

[ad_2]

Resource connection