US Real Estate Markets Top Global Investor Choices: AFIRE

[ad_1]

Investors globally keep on being keen on the U.S. commercial authentic estate market place. 3 in four prepare to raise their quantity of activity this 12 months, and one particular in four anticipate to improve it considerably. Seeking beyond 2022, eight in 10 investors expect to boost their U.S. publicity above the up coming three to five a long time.

Individuals are topline success of the once-a-year investor survey executed by the Affiliation for Overseas Expense in Actual Estate. AFIRE drew on enter from its wide-centered membership of some 175 organizations in 23 countries, symbolizing $3 trillion in belongings under management. CBRE and Holland Lover Group served as underwriters of the study, done in February by AFIRE together with the PwC LLP investigate team.

“I’ve observed that the most profitable among the us—both inside and over and above the world serious estate investment community—can acknowledge uncertainty and continue to feel out the way forward,” Gunnar Branson, CEO of AFIRE, wrote in a letter prefacing the report. “They pay attention to many others to obtain out what they’ve observed, and, via this, they avoid the pitfalls of assuming that one thing will do the job just because that’s how things worked in the earlier.”

New Favorites

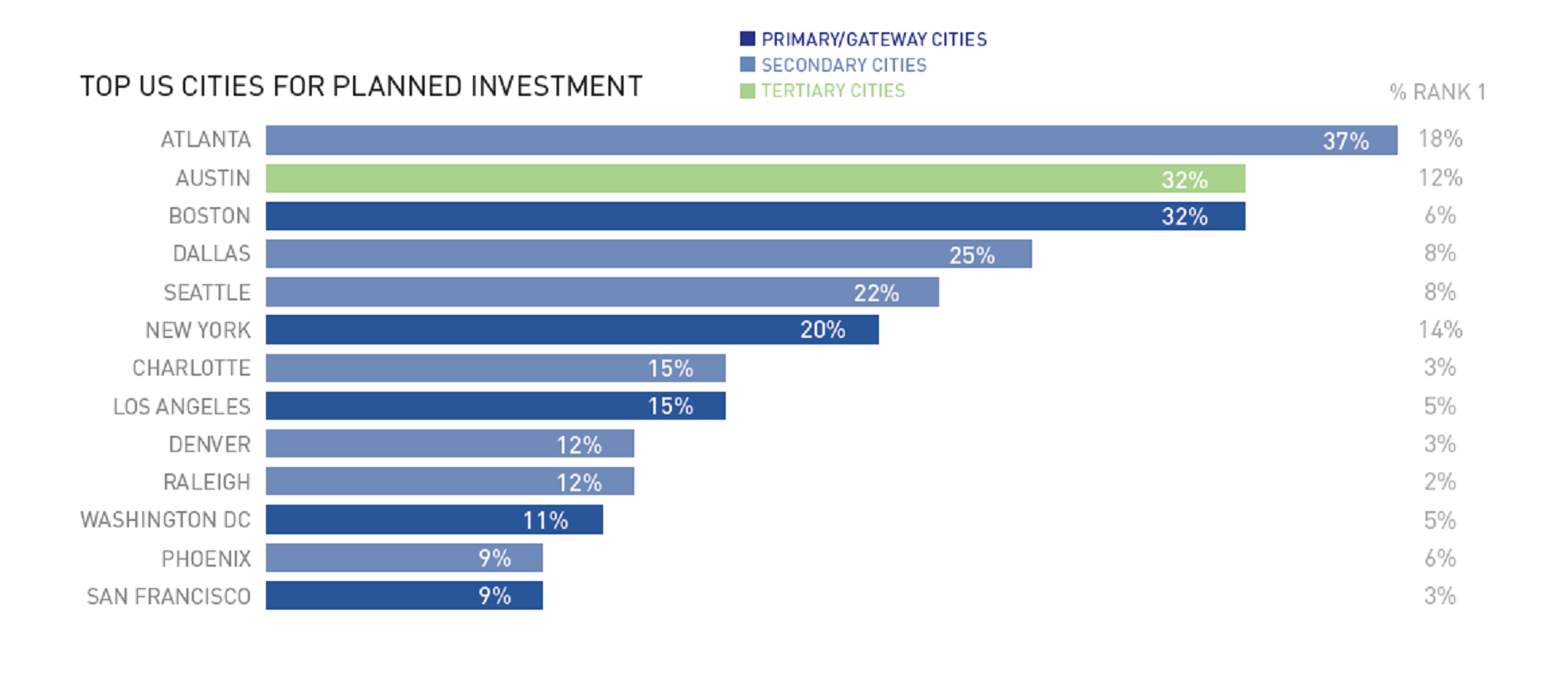

In a indicator of transforming strategies, the study reveals that tier-one marketplaces like New York City and Los Angeles no for a longer time continuously top institutional investors’ lists. Secondary and tertiary cities have risen to the best issue on investors’ radar. Atlanta, a secondary city, was the prime U.S. preference among respondents, with 37 percent deciding on the town the tertiary current market of Austin was picked by 32 %, tying main sector Boston for the variety-two location.

In a telling outcome, U.S. marketplaces also took eight of the major 10 spots between worldwide marketplaces. Austin took initial position among traders, named by 28 per cent, adopted by Atlanta with 26 percent. Close driving in third and fourth put ended up Boston and Dallas, which each individual obtained 23 % of the vote. Other U.S. marketplaces in the leading 10 have been New York Town, Dallas, Los Angeles and Denver. London and Berlin ended up the only non-U.S. marketplaces to make the top 10.

About asset categories, about the future three to 5 several years, buyers in U.S. real estate will continue to target on very first on multifamily, cited by 90 p.c. On the other hand, the lifetime science sector is significant on the record as very well, with 77 percent organizing to improve their publicity. Virtually as quite a few respondents, 75 percent, intend to extend their exposure in the industrial sector. Not all sectors are in superior favor with the financial investment local community. Twenty-5 % of study participants indicated that they strategy to lower their participation in the office sector about the upcoming a few to 5 decades.

Lingering Results

When investors’ outlook for the U.S. marketplace continues to be on its several years-extended optimistic observe, it is various from earlier forecasts due to the prolonged arm of the pandemic.

“Eighty-just one percent of the respondents believe that the pandemic has completely altered tradition and are living-function choices,” Branson informed Industrial Home Executive. “There has been a good deal of dialogue in excess of the previous two a long time about the prospective impact of changes in how and in which we work many thanks to the pandemic.

“Some are predicting a return to usual, other people the total transformation of the CBD. There is no way to know at this level if possibly serious will be true however, with a clear the greater part accepting ‘permanent’ transform, it is apparent that buyers aren’t expecting a ‘return to ordinary.’ Their financial investment focus on secondary markets, on alternate asset courses, and on ready to see what occurs in business office is a modify from decades past.”

The world study noticed a sizeable year-in excess of-yr soar in investors’ sentiment towards ESG requirements, with 81 p.c of respondents indicating that the benchmarks would be extremely important above the next five years, in comparison to 69 percent in the 2021 survey. Of the ESG priorities, 90 percent of individuals put the best value on carbon footprint reduction actions, with 89 % citing actionable local climate improve techniques as a prime precedence.

“A new problem this calendar year was no matter whether they would be prepared to accept a reduced level return if the financial investment experienced a effective impact on the culture or environment. Fifty-5 percent said of course,” Branson instructed CPE. “The world wide institutional investor local community is very major about ESG, specially Europe.”

[ad_2]

Source url