March TRREB Stats: London Calling!

[ad_1]

Well, that was an eventful week, wasn’t it?

Chris, Tara, and Matthew wrote guest blogs? You don’t say!

To be quite honest, I was thinking about pre-writing three blogs, or, as is often the case, writing blogs while I’m away on vacation. That always seems easy in advance (“I write three blogs per week, I’m sure I can carve out the time while I’m away!”) but it’s an absolute nightmare once I attempt this in practice.

I’m not sure who on my team first asked the obvious question: “Why don’t we write the blogs while you’re away?” But it was a great question, and one that seemed rhetorical once the question lingered in the air for a few moments.

Chris was up first, naturally. He started to write his while I was away, and as much as he asked me to look it over, I kept telling him, “I don’t want to be a part of this; surprise me!”

Matthew agonized about his. “I’m nervous,” he told me over text message, as I watched my daughter and her cousins indoor rock-climb. “What if people rake me over the coals?” I told him that he hasn’t made it in real estate until people hate him, so he should hope that some shade is thrown his way!

And Tara? Poor Tara! The newest member on the team was given a task tantamount to pulling Excalibur’s sword from a rock!

Libertarian had a great idea: why not have my mother write a blog?

Save that for next time. Let’s see what other trips my wife has planned for 2022…

London was amazing. A notable stop in the journey of life, and one which my 5-year-old daughter will remember forever.

For those who don’t care to know the minutiae of my personal life, feel free to skip below to the market update. For those with a sense of adventure, I have a LOT of stories to tell! There are so many good ones, but let me pick one story that perhaps some of you can relate to since it’s about something we all have in common: coffee.

Do Brits have a sense of humour? Apparently not! I agonized about the coffee I’d be forced to drink upon my arrival in London, since I’m hopelessly addicted to Tim Horton’s, and as I recall from 2018, they don’t do “drip coffee.” An Amerciano? Isn’t that just espresso mixed with hot water?

We went out for brunch on our first day and I said to the waitress, “I’m from Canada, and I love terrible coffee!”

She looked at me, straight-faced, and said, “We don’t have terrible coffee here. We only have exceptional coffee.”

Right. Sense of humour, anybody?

My sister-in-law interjected and said, “He’s just kidding, he means he just wants something similar to what he has at home.” She then asked, “Do you have cream?”

The waitress looked aghast! She immediately shot back, “Nay. We don’t have cream!”

Apparently, “cream” in London means “whipped cream.” She assumed that I wanted whipped cream on my coffee.

Lindsay then clarified, “I mean pouring cream,” and you could hear the chuckles from the blokes on the other side of the kitchen counter, watching the obnoxious American attempt to settle into high-class London life.

Once my nieces took their hands away from my mouth and allowed me to speak, I said, “Do you have a really, really, really big coffee? I have one in Canada called an ‘extra large’ but it’s, um, like, really XL, ya know?”

Fast-forward three-and-one-half minutes precisely, and a large cup of coffee magically appeared before me! Twas no joke. Twas an “extra, extra large coffee.”

Armed with a beaker of “pouring cream,” I mixed the brew and the skim white liquid like an alchemist. When it was complete, I turned the cup, left, left, left, left, and then left, and soon realized that there was no handle on the cup, and in fact, they had brought me a BOWL.

A bowl!

That’s what the loud American gets for asking for an “extra, extra large,” coffee, in addition to asking for said coffee to be terrible, and having some sort of whipped cream…

Now faced with a large bowl of coffee, the real decision was upon me: do I take this spoon, and drink it like soup? Well, when in London.

I had barely raised the spoon to my tender lips before the entire table erupted in disapproval, and with the appropriate amount of laughter. It seemed the objective here was to hold the bowl full of coffee and drink like a “normal(?)” person would.

What an adventure!

And this was only the first day. And this was only coffee!

The trip was magical. It melted my heart to see Maya play with her cuzzies, but all the while, it pained me to know that all trips end, and it wouldn’t be long before I was putting her to bed in Toronto with her crying for her cuzzies all over again.

I was overwhelmed with emotion upon our arrival. I put a video of this in my Pick5, as well as a photo where this salty discharge erupted from my eyes. Apparently, these are something called “tears,” and there were many of them that day! Not sleeping for an entire 7-hour flight will cause a person with no physical energy to run on emotional energy, but I couldn’t sleep, because I was too busy tending to my daughter who basically threw up for the entire flight, and then had to sit with me on the tarmac for forty minutes after the bus left without us because we were waiting for our stroller. Awful, awful flight. My biggest fear realized…

But enough about London!

What in the world is happening in the real estate market?

I’ll admit, I was on my laptop at least three hours per day, every day, since there are no true “vacations” in our industry, or at least not to me there aren’t. I monitored our activity both on the listing side and the selling side, and it seems like the market, as predicted, has slowed down a little.

Now do not take this as an indication that the “crash” is coming, but rather after seeing the average home price increase nearly $200,000 from December to February, we will likely see the average home price level and then tail off this spring, as it does every year.

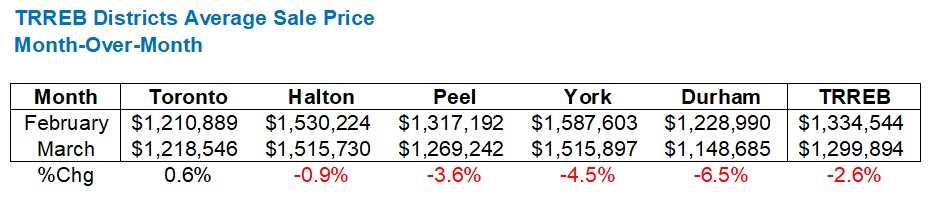

Per the TRREB stats released last week, the average home price declined by 2.6%, month-over-month, from $1,334,554 to $1,299,984:

For the bears, I think it’s tough to make an argument that the second-highest all-time average home price is an indication of a week market.

In my mind, this is simply a return to something resembling normalcy.

I distinctly remember where I was when I heard both the January average home price and February average home price, and while it wasn’t quite “Where were you when you heard that JFK was shot,” I will say that to hear the average home price increased $85,000 and $92,000 respectively in two months to start 2022, it was more than simply memorable.

So was I surprised to see the average home price decline this month?

Not at all. In fact, in my monthly eNewsletter I suggested that it would happen in either March or April.

I would have, however, been surprised by a decline of 5% or more. To me, 2.6% is almost a rounding error in this market.

Now, the obvious question becomes “why,” or better yet, “how” the decline took place, and to answer those questions, we look at where:

Interesting that the 416 held firm, and in actual fact, increased by a true rounding error of 0.6%.

Halton barely moved, whereas areas like York and Durham, which have seen the highest increases in the last 24 months, showed the largest decline.

Is it fair to say that the days of the $600,000 Durham townhouse, in December, selling for $700,000 in January, and $800,000 in February, are over? Maybe, maybe not. But we’re talking 6.5%, and with any month-over-month figure, we have to consider the sample size and what one month can say.

So what of the 416 then?

How does this modest 0.6% increase, in the face of a 2.6% decrease TRREB-wide, look by property type?

A 7.4% decline in the detached market seems shocking, but again, I would look at the “one month effect.” I have no doubt that your average detached house sold a little lower in March than in February, but not by $150,000 as the above figure shows.

I was very surprised to see the semi-detached average increasing. That is going to come down in April, no doubt.

The condo market, of all things, kept moving! I’m seeing the condo market trail the housing market right now in terms of adjusting to increased inventory, but I also think that $831,531 figure will level off next month.

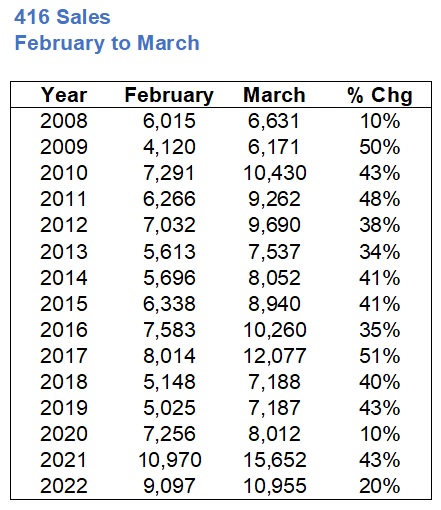

Sales were up by 20.4% on a month-over-month basis, but what does that mean?

Nothing, really. Sales are always up on a month-over-month basis from February to March.

So then, if we’re going to talk about market activity, we’d have to look at past months of March. But in my opinion, we’d also have to look at the relationship between February and March, otherwise we’re just cherry-picking March data.

Here’s the month-over-month increase from February to March for the last fifteen years:

The average increase from 2008 through 2021 is 38%.

Suffice it to say, the 20.4% increase this year trails significantly.

So do we choose to look at the 10,955 sales as the third-highest all time, and conclude that March was busy? Or do we choose to look at the month-over-month increase as the third-lowest in the last fifteen years, and conclude that March was slow?

That question can’t be answered without inherent bias, so let’s move on and run the same data for new listings:

Here we see that new listings increased by 41.6%, month over month, which is higher than the 2008 through 2021 average of 39%.

So the increase in month-over-month sales from February to March trails the preceding fourteen-year average, but new listings outpaces the average.

This means that inventory is being absorbed at a slower rate, albeit modestly, but it’s worth noting as we want to see if this trend continues.

Let’s run the same data for active listings:

Active listings increased a whopping 45.6%, month-over-month, which puts it in a virtual tie with 2017 for the highest February-to-March increase in the last fifteen years.

The average increase from 2008 through 2021 is 20%.

In my March eNewsletter I said the following:

…do the math, and the absorption rate went from 70.6% in January to 64.3% in February. But if this market is going to balance, we need to see that figure push toward 50%.

Not that I was trying to channel the market spirits or anything, but the absorption rate, aka SNLR, did move toward 50%, checking in at 54.7%.

That was a 9.6% drop from the 64.3% recorded in February, which shows the market is becoming more balanced.

But how did that 9.6% drop from February to March look when compared to the previous fourteen years?

Like this:

Amazingly, in this fifteen-year period, the SNLR has increased from February to March seven times, and decreased eight times.

How in the world should anybody expect to accurately predict the market then?

Well, they shouldn’t.

7/15 or 8/15 is basically a coin-flip!

Now, let’s tie this all together.

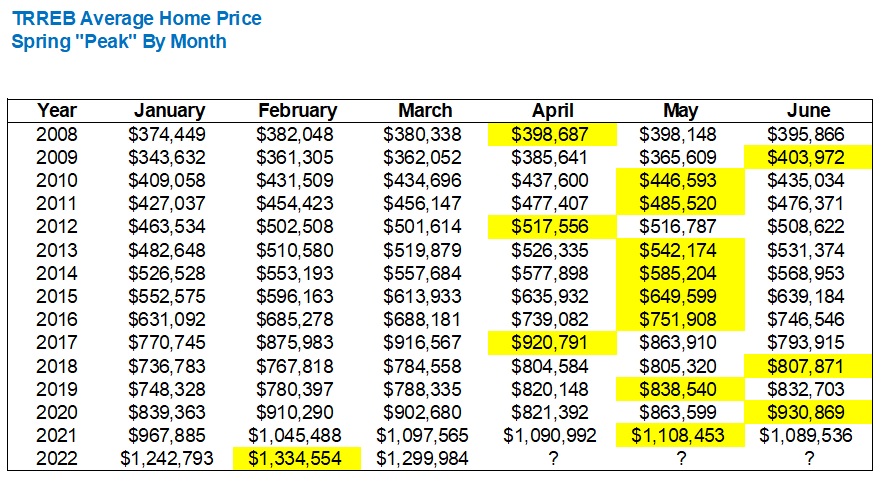

We’re talking about the market potentially “peaking” in February.

Has that happened before?

Better yet, when do we expect the market peak, at least based on history?

I’ve long-maintained that the market usually peaks in May.

By June, most spring buyers have bought, many people are focused on summer, and we wouldn’t expect to see a June average sale price beat out May.

By the same token, as busy as March and April are, the market usually continues upward momentum into May.

For this reason, I say the market “usually” peaks in May, but not always.

Here’s a fun chart, and one that I think could be the most interesting in a long, long time:

Raise your hand if you knew that we had never, at least in the past fifteen years, peaked in March?

For those playing along at home:

May – 8

June – 3

April – 3

And we won’t include the 2022 February peak yet, because I think there’s a 50/50 shot that a balanced April leads to an uptick in May, and once again, we could see the Toronto average home price peak in May.

What would stop that, in my opinion, is weakness outside the 416.

Call me biased because I’m primarily a 416 agent, but I’ve heard from colleagues outside the core that “the party’s over” in Durham and York. If those average sale prices continue to decline, that’s going to drag the overall TRREB price down as well.

My first order of business in this space next month is to look at 416 versus the other TRREB districts.

On Wednesday, let’s look at the Federal government’s budget, which, interestingly enough, seems to deal a lot with housing!

[ad_2]

Source link