Making Sense of the Multifamily Market Today – June 2022

[ad_1]

The multifamily sector nowadays is the strangest in my fairly quick career (12 many years). The selection of probable economic outcomes is vast, and I undoubtedly absence the working experience to evaluate the impression inflation, costs, and a recession may well have on the multifamily current market above the in close proximity to-term.

What is good about obtaining this outlet is that I get to write factors down and assume out loud, documenting my feelings and performing my very best to make sense of the market.

Though admittedly I’m not positive what is going to take place, the more than-applied adage rings legitimate – although record may not repeat by itself, it does rhyme.

Let us break matters down into a couple various segments inflation/rates, solitary-household housing, provide/demand fundamentals, and thoughts/items to view.

Inflation / Rates

Serious estate, and multifamily in unique, is a superior inflation hedge. Rents reset each day, and leases typically roll each individual 12 months. Hire advancement at our current houses have significantly outpaced inflation.

Despite the fact that inflation fears are large these days, the consensus is that it will be tamed, but at what value?

Offered inflation is a relatively quick-time period concern, the current market is reacting far more acutely to the rise in fascination costs. The surge in borrowing prices have pushed up cap prices and introduced the money markets to a momentary freeze. This has been most notable on worth-add discounts where by buyer’s generally set on higher leverage.

I anticipate rates to remain substantial, but normalize and occur again down as recession fears established in. Spreads should really also stabilize as we get more clarity on the sector way.

One-Family Housing

The single-loved ones housing market is terribly harmful now. Logan Mohtashami from HousingWire has the some of the clearest housing assessment which goes like this (based mostly on this short article):

- The run up in housing charges around the previous 2 a long time has been pushed principally by stock staying at all-moments lows at a time when housing demographics had been incredibly robust.

- Stock has been steadily falling since 2014 and is in an unhealthy place nowadays. Historically stock levels are among 2 million and 2.5 million. We started out 2022 at just 870,000 residences for sale.

- A occupation-reduction recession would be needed to make any kind of distress. Nevertheless, the customer is in a potent financial situation these days.

- Higher costs will sluggish housing desire and we’re by now observing invest in applications slowing, but it’s likely to choose a even though for stock ranges to increase considerably.

Unaffordable housing is a boon for multifamily demand from customers in the short-phrase, but above the lengthy-phrase larger rates will slow housing desire and reasonable pricing, thus making single-loved ones housing much more economical.

The Renter

American buyers reman in very good monetary wellness owing to the blend of a robust labor marketplace, wage progress, reduced leverage, and operate up in housing charges and the stock sector.

One of the greatest motorists and a single of the biggest question marks these days is what takes place to renter house incomes goin forward. When I wrote about the SE multifamily sector again in January, I questioned ‘are rents outpacing wages in these marketplaces to this kind of an increase that there are not adequate large-paying out employment to support them?’

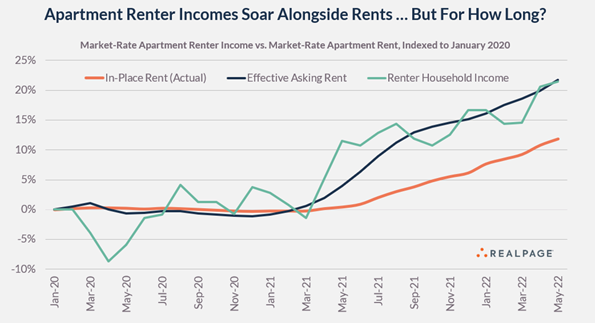

That stays the largest query about the multifamily market today. Incomes and rents are closely corelated. As expenditures carry on to surge, most notably payroll, coverage, utilities, R&M, and taxes, there continues to be stress to press rents.

If wage advancement stagnates, we’ll see extra doubling up, decrease retention, and a reduction in new lease need. See the chart beneath from Jay Parsons of RealPage showing the restricted correlation concerning incomes and rents.

Multifamily Source/Demand from customers

Demand

The multifamily fundamentals continue being robust. Occupation growth and wage expansion are both equally envisioned to continue being healthy. In addition, the uncoupling of younger grownups from mothers and fathers and roommates will continue on to advantage near expression desire. Nevertheless, the demographics soften as the 25–34-yr-outdated cohort grows at <0.5% per year over the next 3 years, then declines starting in 2025 (Green Street).

Additionally, the recent rise in rates and the likely impending recession may lead to hiring freezes and layoffs in certain sectors, resulting in slower than expected job growth.

Revenue growth will continue to be strong due to mark-to-market of the rent roll (especially in the Sunbelt) but will likely slow due to deteriorating macroeconomic conditions.

Supply

On the supply side, development delays have helped insulate apartment fundamentals. However, supply will grow over the coming years as the units under construction eventually deliver and the starts/permits continue to accelerate.

Tightening credit markets and rising construction costs may restrain supply in the short-term, but rising rents (and attractive profit margins) will keep a floor under starts.

Supply will vary by market with the Sunbelt markets seeing accelerating supply growth over the next 2-3 years. There are no absorption issues today, and broad-based excesses in supply are unlikely in the near-term given the strong demand, but select markets are heading for over-supply.

Questions/Things to Watch

- Are we heading for a recession and if so, how severe will it be?

- Will the labor market remain tight and will wage growth continue?

- Will supply catch up to demand and are select markets over-supplied?

- Are rents outpacing wage growth, leading to expanding rent-to-income ratios?

- Will rates normalize then begin to decline as recession fears set it?

- When will supply-chain issues taper and will construction costs come back down any time soon?

While this is my attempt of making sense of today’s market, I remain focused on buying and building multifamily assets to hold long-term in markets with strong fundamentals.

[ad_2]

Source link