KKR Real Estate: Seeking The Best REIT For Retirement Income (NYSE:KREF)

[ad_1]

CHUNYIP WONG/E+ via Getty Images

One of the main reasons why I enjoy writing for Seeking Alpha is because of the prolific exchange of information, ideas, and opinions that can be generated from a piece of research analysis on an investing topic or suggestion. I am not a financial expert or a subject matter expert on real estate investments, but I do appreciate the fact that a good choice at the right time can provide me with some long-term income if I do my research well and respect other people’s opinions (but not necessarily agree).

Recently, I wrote an article on a business development company (“BDC”) that offers a high yield and some capital appreciation potential for long-term investors. That article generated a lot of discussion in the comments section regarding whether it was the best BDC to recommend investors buy at the time that I wrote the article (it was a Hold recommendation in that case, yet the discussion was about when to buy).

As I look to build out my long-term growth and income portfolio, I am looking at several real estate investment trusts (“REITs”) to either buy or add to my current holdings. While the market churns along in 2022, punishing many of the high yield sectors that were outperforming over the 5-year period prior to this year, I am looking at clues for what will outperform going forward. So, I search for high yield investments that have performed well in the past and appear to be well-positioned for this new inflationary, possibly recessionary environment that we find ourselves in now.

A space that I am particularly interested in right now is commercial REITs. As an investment vehicle REITs tend to pay out high yields due to the requirement to disburse at least 90% of its income each year to retain REIT status. There are many types of REIT investments in many different sectors, and other authors on SA cover the industry in far more detail than I will here. For example, this recent article from Hoya Capital discusses the “return to the office” trends that are occurring now that the majority of the Covid-19 pandemic is over, and work from home full-time is transitioning back to at least part-time in the office for many employees, including myself.

In this article, I am concentrating on a particular commercial REIT for this analysis – KKR Real Estate Finance Trust Inc. (NYSE:KREF). KREF offers investors relative price stability and a nearly 10% annual yield based on the current quarterly dividend of $0.43. KREF focuses primarily on the office and multi-family segments of the commercial real estate sector.

I feel that the commercial REIT sector is in a good place for investors to either start a new long position or add to an existing one as the market has beaten down the prices of many of them recently. According to some recent research published by JP Morgan Chase, the industry outlook for commercial real estate looks positive for the second half of the year:

Despite rising interest rates-with the potential for more hikes in the coming months-commercial real estate has seen success in 2022. Although the forecast varies among asset classes, the overall industry outlook remains positive heading into the second half of the year.

One of the more popular and larger commercial REITs that gets a lot of coverage on SA is Starwood Property Trust (STWD). In fact, a recent article from Gen Alpha discussed some of the reasons why now is a good time to buy STWD. I like the stock and I may decide to add it my portfolio again, as I held it previously but decided to sell when the Covid-19 pandemic hurt many of the commercial REITs. I initially purchased shares of STWD back in June 2020 for an average price of around $15 but finally sold all of my shares in February of this year for $23. STWD then went down to a 52-week low of $19.69 before climbing back to $22.59 as of the close on July 22, 2022.

In May of this year, I came across KREF. With a market cap of about $1.3B, KREF is not as large as STWD at $6.9 billion. But KREF has the backing of KKR (KKR), a $43B private equity and global investment firm with $479B in assets under management (“AUM”). I started buying shares of KREF in May for around $19 and have averaged down into the mid $17s in July with an average cost basis now of about $18.

In addition to KREF, which I will go into more detail about below, I am also currently holding long positions in two other commercial REITs – Ready Capital (RC) and Arbor Realty Trust (ABR). I decided to compare the total returns of each of these REITs to try to determine which is the best buy based on past results, and then try to predict which will do the best going forward.

Comparing Commercial REITs

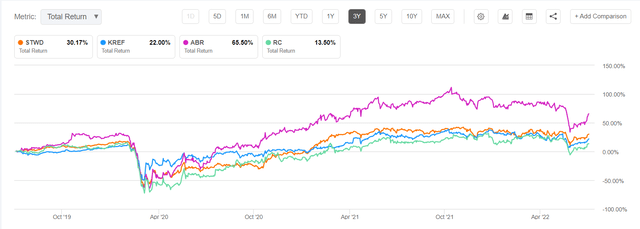

Timing of buys is crucial to comparing long-term returns based on historical results. If we consider the time period of the past 3 years, which was pre-pandemic until now, ABR is the clear winner.

3-yr Comparison of commercial REITs ((Seeking Alpha))

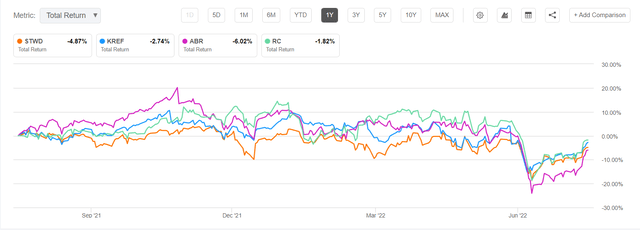

But ABR has suffered more volatility in the past one-year period and is now lagging the others if you look at results from just one year ago until today. Based on the total return over the past 1 year, RC is the winner with KREF in 2nd place.

1-yr comparison of commercial REITs ( (Seeking Alpha))

With my particular investme

nt objectives and risk tolerance, I do not necessarily need to choose the best one to buy today, if I hold for the long term. As another author on SA likes to say, I do not have to win the race with the horses that I bet on, I only need to place. And that is especially true with REITs that pay a high yield distribution with an annual yield of 9% or more, as is the case with KREF.

Why KREF and Why Now?

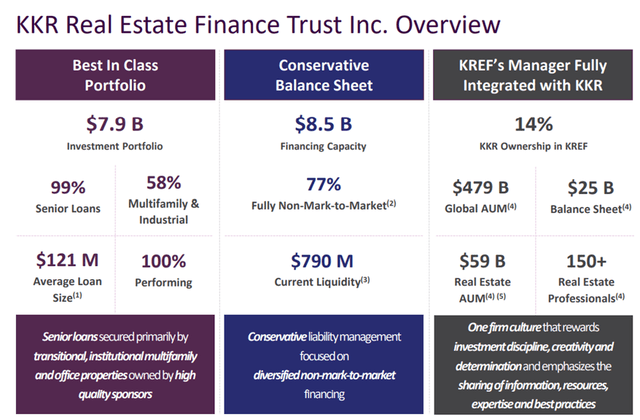

Taking a closer look at KREF reveals that they are a leading provider of structured commercial real estate loans. With an investment portfolio of $7.9B the loans are 99% senior loans and 100% performing. The average loan size is $121M, and 58% are multifamily and industrial loans.

Founded in 2011, KREF offers an integrated real estate platform and owns or lends on $172B in real estate assets. KKR owns 14% of KREF and offers global reach in financing and sourcing opportunities.

KREF Overview (July 2022 investor presentation)

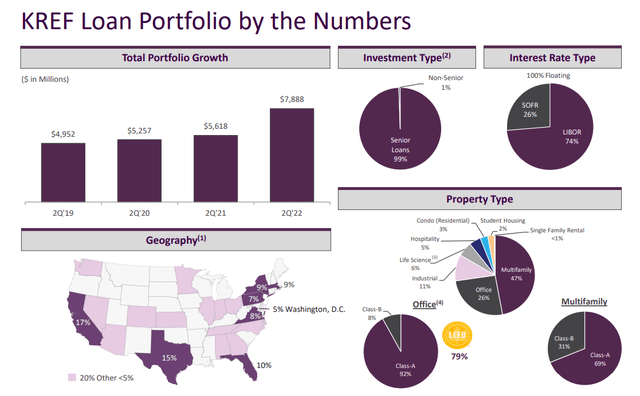

This relationship with KKR provides more than just a broad global base to source new opportunities, it also adds elements of multi-disciplinary quality and leadership experience that results in a rigorous screening and selection process for loan originations. The result is a high-quality portfolio of 99% senior secured loans that are 100% floating rate, spread geographically across most of the largest MSAs (metropolitan statistical areas) in the U.S.

In fact, 84% of the loans are in the top 15 MSAs and 92% are in the top 20 MSAs and are held with high quality sponsors with typical LTV of 75% or less. The fully extended weighted average loan maturity is 3.6 years as of Q222.

KREF loan portfolio ( (July investor presentation))

Financing Overview and Recent Performance

During 2021, the company made 37 loans to high quality institutional sponsors and two thirds of those loans were made to repeat borrowers. In the 4th quarter of 2021, they made 18 loans totaling $1.8B, 13 of which were multifamily, 2 in office, 2 in life sciences, and a $66 million loan in hospitality. In the 4th quarter 2021, the company took a write-off on loans leading to a loss in the quarter for the first time since going public. From the Q421 earnings call transcript:

For the fourth quarter of 2021, we had GAAP net income of $35.2 million or $0.59 per share. Distributable earnings this quarter were negative $2.9 million or negative $0.05 per share due to $0.55 per share in realized losses on loan write-offs this quarter.

In May 2022, the company celebrated its 5th anniversary as a public company. Reported earnings were $0.47 for the quarter. First quarter loan originations consisted of 9 floating rate senior loans totaling $844 million with $618 million of initial funding. They received $282M in loan repayments and 100% of interest payments due in Q1.

Book value per share saw a steady increase from $18.89 in Q121 to $19.37 in Q421 and was calculated at $19.46 as of March 31, 2022. As of July 25, 2022, book value declined slightly to $19.36 due to a $34M CECL credit loss allowance. At the closing price of $18.70 as of 7/25/22 the shares are trading at about a 3% discount to book value.

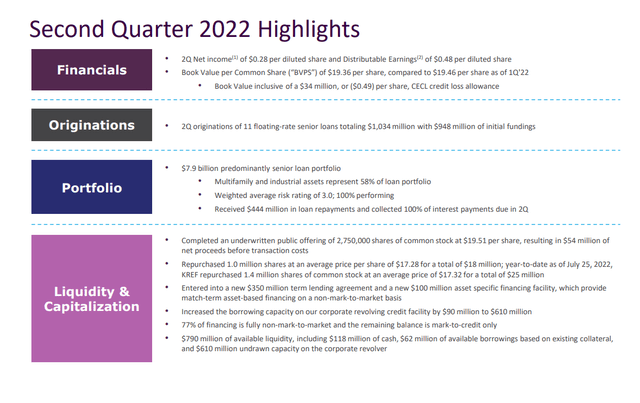

Q222 results were announced today, July 25, 2022, after hours as explained in this supplemental report. Second quarter distributable earnings per share amounted to $0.48. There were 11 floating rate senior loans originated in the quarter, totaling $1,034 million with $948 million of initial funding. They received $444 million in loan repayments during the quarter and collected 100% of interest payments due. Revenue of $50M represents 20% YOY growth.

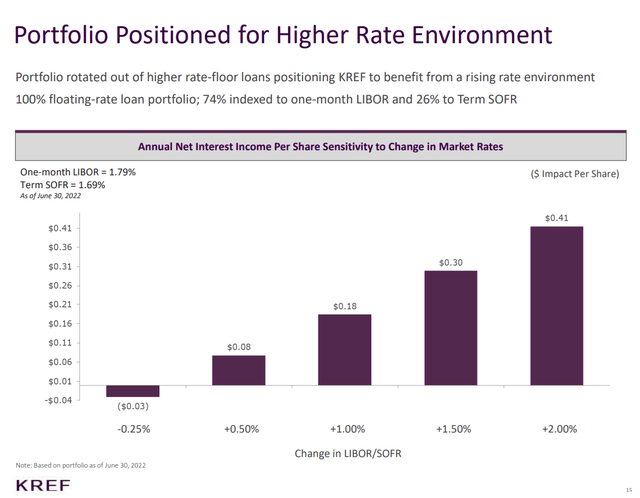

The majority of loans in the portfolio are positioned for higher rates going forward, which will likely lead to increases in net income as the Fed raises the base borrowing rate.

Portfolio positioning ((July earnings presentation))

The overall financing services available to KREF amounts to $8.5B from diversified sources with $2.5B of undrawn capacity. Leverage is currently at 3.2X total leverage with a 1.5X debt to equity ratio. Total available liquidity as of July 25, 2022, amounted to $790M with $118M in cash, $610M available on an undrawn corporate revolver and $62M of available borrowings based on existing collateral. About 77% of financing is from non-mark-to-market sources and the remainder is mark-to-credit. In addition, KREF had $416 million in unencumbered senior loans that can be pledged to financing facilities (subject to lender approval) as of June 30, 2022.

Q222 Earnings Summary ( (Q222 Earnings Supplemental report))

Dividend History and Coverage

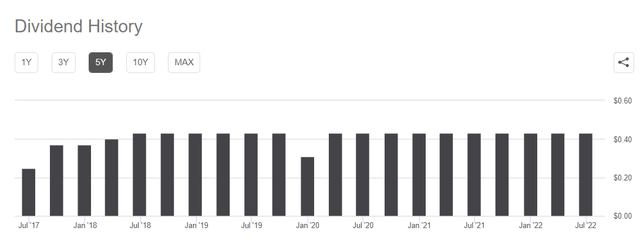

With a history of paying a regular quarterly dividend every quarter since going public in 2017, KREF has paid $0.43 every quarter since July 2018 except in the 4th quarter of 2019 when they had to make an adjustment. Distributable earnings in the first quarter of 2022 were $0.47 per share, easily covering the $0.43 dividend. The most recent dividend declaration of $0.43 was made on June 16, payable to shareholders on July 15. And based on Q222 results it appears that the dividend is still well covered with another $0.48 of distributable income earned in the quarter ending June 30, 2022.

KREF dividend history ( (Seeking Alpha))

Risks and Summary

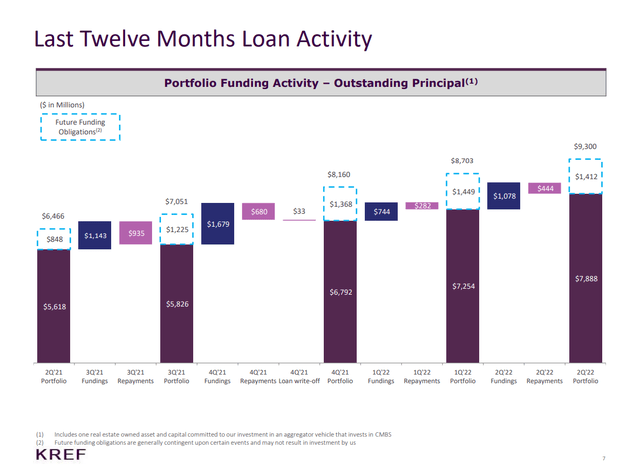

During the last 12 months of loan activity, there was one quarter (Q421) where KREF incurred write-offs. It is not likely that there will be additional write-offs in the next 12 months unless the capital markets dramatically shift from the current state, which could happen if the recession worsens over the next six to twelve months as some are predicting. Rising interest rates do not pose a risk, but in fact could lead t

o additional gains in net income based on the floating rate nature of the majority of the loans in the portfolio. This chart from the July investor presentation illustrates the recent growth in loan funding in the KREF portfolio.

Loan activity for last 12 months ( (KREF July investor presentation))

Given the challenges of the market in the first half of 2022 with two quarters of receding economic growth, the loan portfolio continues to demonstrate positive growth and stability. It is my belief that if KREF can navigate the first half of 2022 successfully with all the challenges present in the market, then the prospects for continued future growth look promising. With a well-covered distribution that is yielding nearly 10% annually at the current market price, KREF is a strong buy for income-oriented investors with a long-term horizon.

[ad_2]

Source link