Imminentness of Mortgage Infrastructure and Customer Adoption

[ad_1]

[Editor’s Note: Below is the full text of our 216th Weekly Transmission, originally delivered direct to the inbox of more than 500 GEM members on June 15th, 2022.]

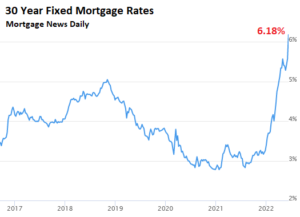

The 30-year fixed mortgage rate is approaching 6%, no doubt catching the immediate attention of both the millions of US homeowners with mortgages and aspiring homeowners alike. They’re now facing borrowing costs not seen in over a decade. For industry vets, it’s no surprise—the mortgage industry is a cyclical one. And, inevitably, with challenging times, comes opportunity. Delivering technology that makes the entire mortgage process more customer-friendly, and more efficient for the businesses themselves, is a huge opportunity that I’m excited about.

The 30-year fixed mortgage rate is approaching 6%, no doubt catching the immediate attention of both the millions of US homeowners with mortgages and aspiring homeowners alike. They’re now facing borrowing costs not seen in over a decade. For industry vets, it’s no surprise—the mortgage industry is a cyclical one. And, inevitably, with challenging times, comes opportunity. Delivering technology that makes the entire mortgage process more customer-friendly, and more efficient for the businesses themselves, is a huge opportunity that I’m excited about.

Now is the time for mortgage technology companies to gain traction, and for customers to adopt technology while they have the bandwidth to implement it. Players in the mortgage business using their time wisely now to de-risk future cash flows currently transaction-dependent will be in a strong position during the next big boom with advanced, well-proven, and efficient new processes in place.

MOMENTUM BUILDING

In 2021, 6.12 million existing homes were transacted, according to NAR—the highest since 2006. On top of that, many people refinanced their homes to lock in lower rates. It was mayhem. The past year also ushered in a wave of exciting new technology startups (e.g. Braid, Pine, Willow Servicing) tackling every area of the mortgage process, from front end (originating, underwriting, and closing) to the back end (servicing and capital markets). And the demand was there!

But the frenetic pace unearthed something broken in the mortgage industry. Many human processes, from underwriting all the way to loan sales, are simply not scalable.

The sheer volume of activity over these last two years underscored the deep need for new technologies, but with such volume flowing through the system, few lenders had time to adopt and integrate new technology. The existing systems might have been broken, but they were a known quantity, and they worked.

Now it’s 2022. With rates higher than they’ve been in a decade and the refinance market dropping off a cliff, we’re seeing layoffs across the board (eg. Tomo, Better, Wells Fargo, KW Mortgage, Knock). But in a cyclical industry, this is not a surprise (and it is not the first time this has happened).

As a result, this is the year for technology focused on mortgage infrastructure to finally make processes more efficient and streamlined. Based on discussions with builders in the space, lenders are more ready than ever to buy and adopt these solutions.

A common business model in the residential real estate space is to take a percentage of the home transaction value, or a percentage of the loan, or a fee per loan. The down cycle will see a push toward predictable revenue streams (like recurring subscriptions) versus transaction revenue.

In times when volume is high, this business model is attractive and was the direct cause of massive revenue growth in the mortgage sector last year. The challenge is that when volumes drop (i.e. when refinances stopped) so does revenue, which results in companies going through layoffs simply in order to manage cash flow.

A THREAD OF CERTAINTY

This cycle isn’t surprising in the well-established mortgage industry, but in the venture tech world, cyclical revenues can be challenging. And layoffs, regardless of industry norms, impact morale and external signaling to customers/investors and potential hires, especially as companies raise external capital every 1-2 years. Therefore, a push to a recurring subscription revenue model for tech-based businesses serving the mortgage industry is appealing. Building a degree of predictability into your business model may not result in the steep “up and to the right” trends most businesses in this market saw last year, but will ensure control of its operations.

A range of companies are already building compelling solutions in this space—Reggora, Vesta, Polly, Haven and Stavvy to name a few. That said, and as dramatic as the shift has been, the opportunity to build truly game-changing technology for the mortgage sector is stronger now than ever. And the challenging market dynamic will be a forcing function to discover genuine product-market fit.

the GEM BRIEFING

A PRIVATE GROUP OF INDEPENDENT THINKERS, FREE FROM SPONSORED MESSAGES, SALES PITCHES AND NOISE

There are four parts to membership:

GREAT THINGS ARE HAPPENING

- Transmissions and Radars have become a trusted signal for industry news and analysis.

- Articles and ideas are regularly discussed in product & strategy meetings.

- Our virtual workgroups bring together a diverse mix of C-Suite execs to discuss real issues.

- We’ve introduced members to new vendors, partners, and friends.

With a mission to attract the 1,500 most forward-thinking, and diverse, innovators, we’re looking for the best and brightest in all the land...

Membership is $139 / quarter

READY TO JOIN RIGHT NOW?

NOT QUITE READY?

[ad_2]

Source link