Construction Jobs and Spending Briefs 4-1-22 « Construction Analytics

[ad_1]

Development Work report for Mar 2022 displays overall jobs up 19,000 from Feb

Rsdn work opportunities +7,600, Nonres Bldgs +6,300, Civil +5,000

Although development employment enhanced by 19,000 in March, overall hrs labored dropped by 1.8% from Feb, so total workforce output is down.

It’s serious challenging to review building work expansion by sector. If you get the job done for a concrete agency or structural steel company, with firm carrying out primarily nonresidential work, but you are out there placing in concrete or metal for a superior-increase multifamily properties, your position is still categorized as nonresidential.

Careers are up 82,000 yr-to-date, 1.1% from Dec, but that is also up 3.5% from ytd 2021. With the most up-to-date quarter at +1.1%, work are escalating at a charge of 4%/12 months. But inflation altered paying out, developing action, is anticipated up only 2.5% in 2022, after dropping -2% in 2021. Jobs increased 2.5% in 2021.

2022 paying out began the calendar year at the highpoint. I count on a sluggish drop in regular monthly expending in all sectors of 2% around the 2nd half. That gives no aid for work growth.

Building positions have approximately returned to pre-pandemic amounts. The problem with building work opportunities having returned to pre-pandemic levels is the amount of inflation adjusted design volume of exercise that is needed to assist individuals jobs is still 5% beneath Feb 2020 and 13% under the 2006 peak. So considering that Feb 2020, work opportunities are back to that level, but quantity is not so efficiency has dropped by 5%.

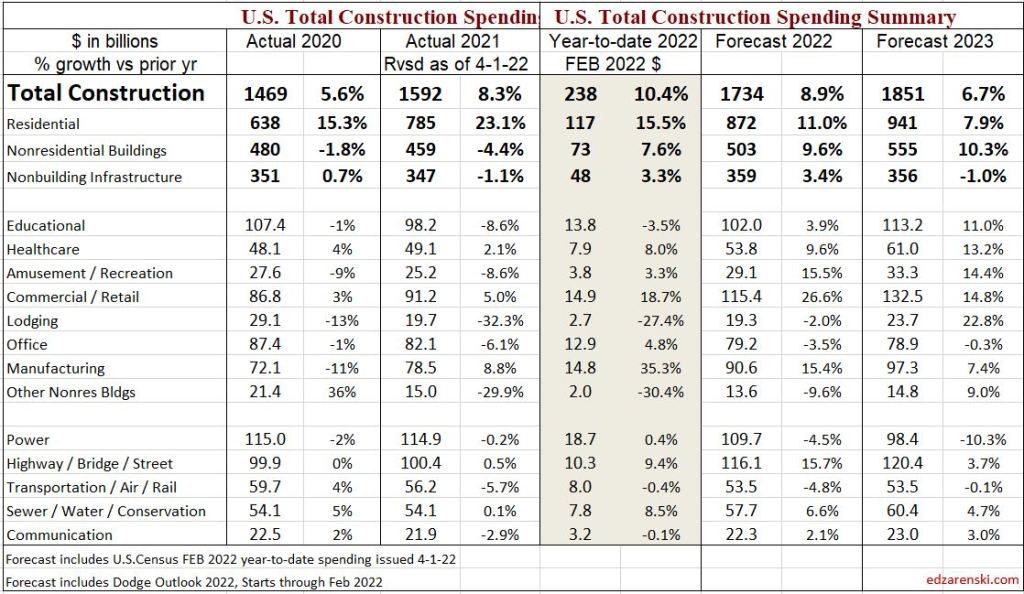

Development Shelling out is up +10.4% yr-to-date (in 2 months!) generally pushed by +15.5% ytd Residential.

A plot of household development expending inflation altered. Using out inflation reveals quantity of creating exercise. Most likely the pattern in household is solid more than enough to hold likely.

Complete paying out is up +4% in 3mo considering the fact that Nov 2021 (and 10% ytd-2mo), but I do not count on this fee of growth to maintain. However, this and any other altered info inputs revises my 2022 shelling out forecast.

Illustrations of large alterations considering the fact that original forecast:

Production expending has enhanced so a great deal in Jan-Feb, (up 35% ytd) that even if the next 10 months complete flat 12 months/12 months, Mnfg will still complete up 5% for 2022.

Household new begins for the newest 3 mo, Dec-Jan-Feb, avg is as high as any quarter previous year. Almost all of this paying takes place in 2022.

Building properties cost inflation about the past 4 many years is up 25%. Labor expense, wages up 15% & productivity down 7%, is up 22%. But labor is 35% of full developing expense so 22% x 35% = labor is 8% of that whole 25% constructing cost inflation. Thoroughly 1/3 of design inflation in excess of last 4 decades went into staff pockets.

[ad_2]

Source hyperlink