Construction Forecast 2022 Update May22 « Construction Analytics

[ad_1]

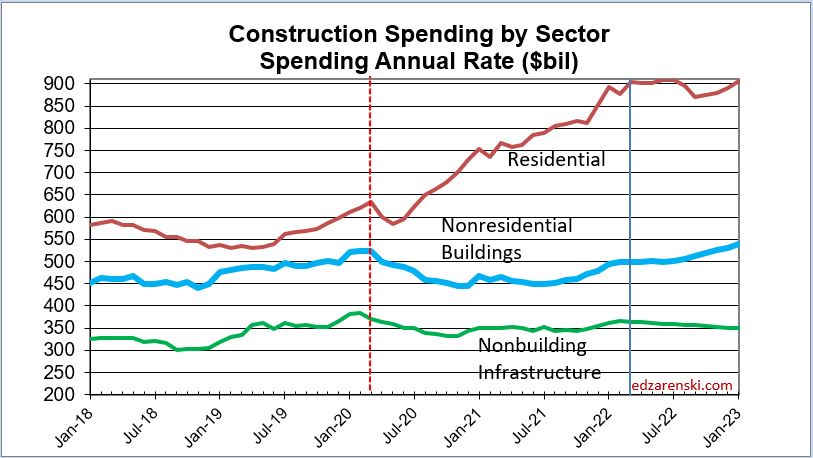

Construction Spending is up +12% year-to-date for the 1st three months of 2022, again mostly driven by residential which is up 18.6% ytd. Total spending is up 11.7% year over year (Mar’22 vs Mar’21).

See end of post for downloadable pdf.

Total construction spending for the 1st quarter 2022 vs the 4th quarter 2021 is up +6.5%. I expect this rate of spending growth to flatten over the next six months.

Residential is about half of all construction spending. For the past 6 months, residential construction starts ($ by Dodge) posted the highest 6mo total ever recorded. Dec, Jan and Mar are all near Feb, the highest monthly total on record. This implies no slowdown in residential spending at least for the next 6 months although I expect by year end, residential (annual rate of) spending will be down about 2-3%.

Spending up year-to-date: Manufacturing up 34%, Commercial/Retail up 18% and Highway up 9%.

Spending down year-to-date: Public Safety (80% of Other) -31%, Lodging -27%.

Now 2 yrs since the onset of the pandemic, total construction spending in March 2022 is up 15%. Residential spending is 42% higher than March 2020, Nonresidential Bldgs is down 5%, Nonbuilding Infrastructure is down 6%.

Why is spending coming in well above any forecast prepared at the beginning of the year? Since October, new starts have come in much stronger than predicted, 8% higher than the previous high 6mo period which immediately preceded. But some markets increased way above average, residential and manufacturing. This most recent 6 month period for nonresidential buildings includes two months in which starts came in 30% higher than average. You can’t predict that. Residential construction starts posted the highest 6 month total ever recorded and Q1 2022 is the highest quarter ever. Not only are starts stronger than expected, but also the very high rates of inflation are inflating the spending data. Original forecasts for spending did not anticipate all types of work would experience such high inflation.

Construction buildings cost inflation over the last 4 years is up 21%. Labor cost is two parts, wages up 15% & productivity down 7%, for a net cost up 22%.

Labor is 35% of total building cost so 35% of cost that is up 22% = labor is 8% of that total 21% building cost inflation. Therefore, 8% out of 21% or fully 1/3 of construction inflation over last 4 years went into workers pockets.

Take out inflation and we get construction volume. In 2 yrs since the onset of the pandemic total construction volume (spending minus inflation) is down 2.5%. Residential construction volume is up 15%. Nonresidential Bldgs volume is down 16% Nonbuilding Infrastructure volume is down 15%.

Volume, not spending, supports jobs. If volume is down, support for jobs drops. If jobs increase while volume declines, then productivity drops and labor cost inflation increases.

Since Feb 2020, the last 2 years

Volume: Residential is up 10%; Nonres Bldgs down 17%; Nonbldg Infra down 15%.

Jobs: Rsdn up 5.75% (+171k), Nonres Bldgs down 4.5%(-159k), Nonbldg down 2.3% (-30k).

In 2021, jobs increased +2.3%. Volume was down -1.1%.

Post-pandemic recovery volume of construction may have temporarily peaked in the 1st quarter 2022 at 3.3% below Feb 2020. Over the next few months, spending mostly holds level, but inflation eats away at growth and volume declines by year end. This should hold jobs down.

In January, I wrote Construction Forecast 2022 – Jan22 a full length post and article on the Outlook for 2022. Below I’ve updated the complete article to include all data up to May 6, 2022

[ad_2]

Source link