Caterpillar reports 14% sales and revenue increase in Q1

[ad_1]

Higher demand and surprising improves in seller restocking led to a 14% improve in sales and income in the very first quarter of 2022 for Caterpillar.

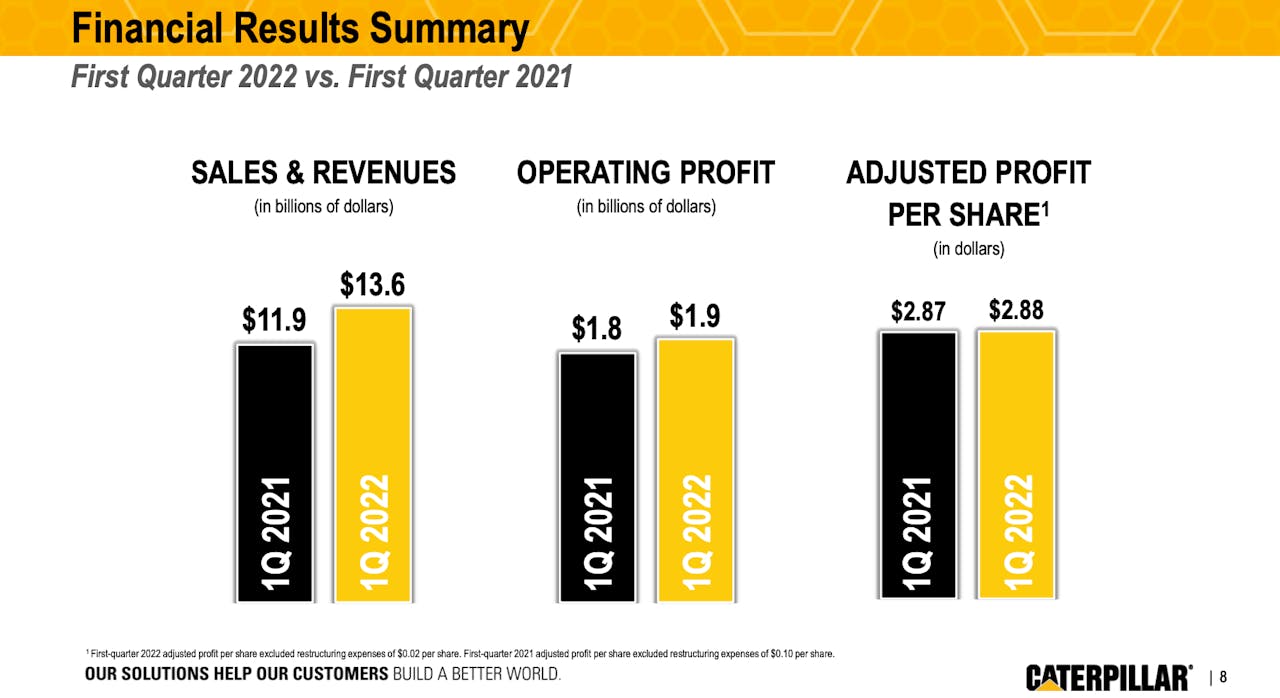

The business announced income and profits of $13.6 billion for Q1 2022 in comparison to $11.9 billion in the identical interval of 2021. It marked the fifth consecutive quarter of greater close-person demand from customers compared to the prior year. Product sales increased throughout all of Cat’s key segments (development industries, assets industries, and vitality and transportation) owing to volume gains and favorable charges.

“We keep on to be encouraged by robust get demand throughout our segments in the initially quarter of 2022,” explained Jim Umpleby, Caterpillar chairman and CEO.

The unforeseen revenue increase occurred from the sellers growing their inventories by about $1.3 billion, nearly double what Cat experienced predicted and about $600 million far more than in Q1 of 2021. Vendor inventories had reportedly remained fairly flat in 2021 just after a $2.9 billion decrease in 2020.

“About 50 percent of that $600 million enhance yea on calendar year arrived from useful resource industries thanks to the timing of shipments from dealers to their customers, which can be lumpy,” said Andrew Bonfield, Caterpillar chief economic officer. “These units are backed by agency purchaser orders who were being not acknowledged in our noted retail product sales for the quarter.” He claimed this is owing in component to versions in onsite assembly times. The CFO stated the remaining fifty percent of the discipline inventory enhance was largely because of to timing in shipments in the design marketplace late in the quarter.

“We anticipate the dealers will begin to promote down the inventories in the next quarter pursuing their typical seasonal sample and solid profits to consumers,” Bonfield mentioned, noting that Cat’s expectations for the full calendar year have not transformed and the corporation does not hope to see a major benefit from vendor restocking in 2022 as stop-person desire continues to be solid.

“While supplier inventories remained in close proximity to the small conclude of the regular array, we continue on to function intently with them to fulfill bigger stop-user demand,” added Umpleby.

Per the report, Cat’s total backlog elevated by $3.4 billion as the firm knowledgeable continued strong demand and provide chain challenges.

“The atmosphere continues to be challenging thanks to provide chain constraints and the a lot more latest COVID 19 connected shutdowns in China,” Umpleby explained. “Although production fees are envisioned to continue being elevated, we be expecting rate to far more than offset these prices raises for the comprehensive year.”

He praised the world team’s effectiveness in obtaining double-digit revenue expansion in spite of the offer chain challenges. Umpleby acknowledged that the top rated line would have been more robust without the need of the provide chain constraints, which had been like individuals highlighted in the Q4 report of 2021.

“We proceed to expertise constraints with semiconductors and specified other parts,” claimed Umpleby. “Our group carries on to put into practice answers to enable mitigate the overall predicament.” Cat has executed engineering redesigns to deliver clients with choice selections and increased dual sourcing of parts and placed specialised Caterpillar means and suppliers to assist simplicity constraints.

“When the provide chain ailments relieve, we assume to be properly positioned to fully fulfill need and gain running leverage from higher volume. In general, we remain encouraged by the strong demand from customers for our products and products and services, and we keep on being centered on supporting our consumers and executing our approach for long-expression worthwhile expansion.”

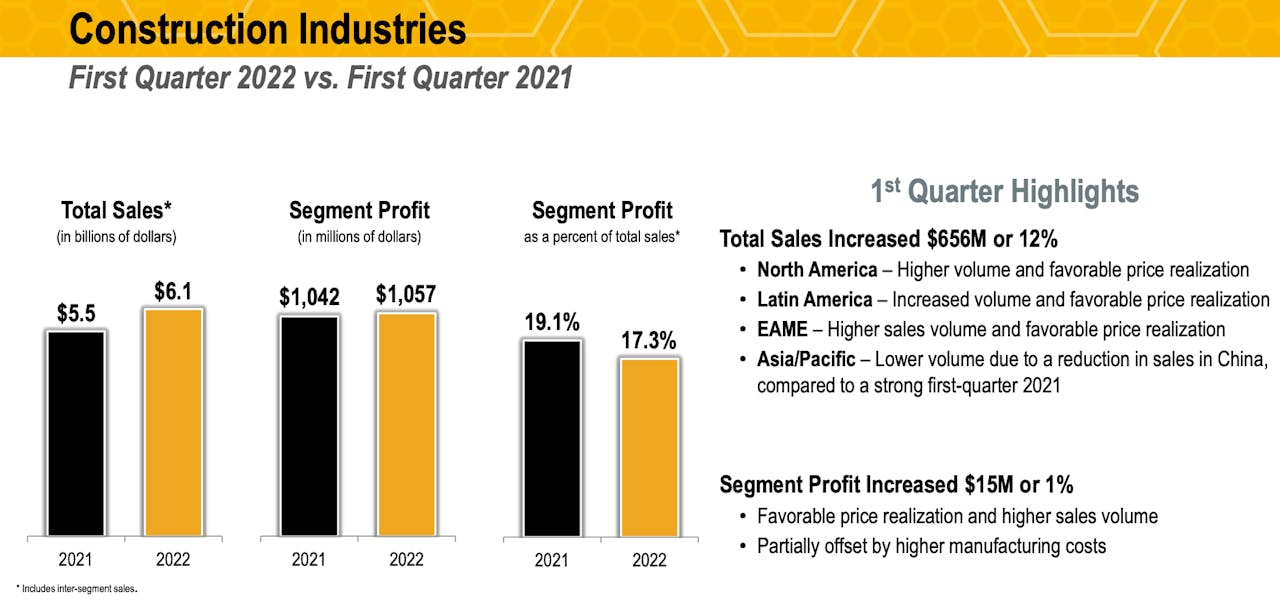

Development profits

Inside of development industries especially, Andrew Bonfield, Cat’s chief economical officer, claimed revenue improved 12% in Q1 to $6.1 billion, generally pushed by federal price tag realization and sturdy gross sales volumes. Close-consumer need improved in a few of 4 locations. He stated the segment’s initial quarter financial gain elevated by 1% versus the prior 12 months to $1.1 billion.

“Price realization and a bigger gross sales volume drives boost far more than offsetting improves in producing costs,” Bonfield stated. “Price realization was stronger than we experienced anticipated but lagged producing expenditures in the quarter.” He pointed out the segment’s working margin decreased by 180 basis factors to 17.3%.

In accordance to the report, the North The usa region experienced the optimum gross sales expansion and gross sales bucks with a 28% improve as non-residential need enhanced, and household building remained robust. “Despite soaring desire charges, infrastructure investment is anticipated to enhance in late 2022 and outside of, supported by the U.S. Infrastructure Financial investment and Positions Act,” Umpleby explained.

The initial-quarter report states that product sales in Latin The united states increased by 60% as general development and mining functions supported increased demand from customers. Even so, continued progress could be impacted by inflation and curiosity fee plan selections afterwards in 2022.

“In Europe, Africa and the Middle East, (EAME), despite the broader geopolitical problems, we remain cautiously optimistic due to housing progress in the EU investment package deal that is envisioned to push design desire,” said Umpleby. In that area, sales reportedly greater 18%, because of primarily to residential construction need.

By the Caterpillar Foundation the business has donated far more than $1 million to guidance both urgent and long-time period needs of the Ukraine humanitarian disaster. Cat suspended operations at its Russian producing services.

Conversely, with lowered gross sales in China, Cat’s Asian Pacific gross sales lessened by 21%. The 10-ton and higher than excavator market place in China was robust in 2020 and 2021. Umpleby reported they are anticipating the current market to be a little reduce than 2019 amounts, when the remainder of the Asia Pacific region is expected to grow owing to greater infrastructure shelling out.

Functions

Operating profit margins were being 13.7% in the first quarter of 2022, which was decrease than the initial quarter of 2021.

“We expected comparisons would be difficult as inflationary influence to production fees accelerated in the back again 50 % of 2021 and stays at a related degree in the initially quarter of 2022,” claimed Umpleby.

On a sequential basis, margins improved as opposed to the fourth quarter. He stated Cat’s initial-quarter 2022 earnings per share was $2.86, when compared with 1st-quarter 2021 revenue for every share of $2.77. Altered gain for every share in the very first quarter of 2022 was $2.88, as opposed with to start with-quarter 2021 altered profit per share of $2.87. Modified profit for each share for each quarters excluded restructuring prices.

Bonfield observed that Cat is not anticipating a typical 12 months on mar

gins in 2022.

“In a ordinary 12 months we’d see solid margins in the 1st quarter with margins decreasing sequentially through the fourth quarter,” he stated. “This year we expect margins to increase in the 2nd half of the yr as opposed to both equally the initial fifty percent and the similar period of time of 2021 as the influence of value steps speed up.”

Commonly, value increases are anticipated to continue to offset producing expenses all through the yr, with margins getting close to or better than 2021 in the construction sector segment.

Cat Economical

Cat Economical claimed first-quarter 2022 revenues of $652 million, an raise of $13 million, or 2%, when compared with the to start with quarter of 2021. To start with-quarter 2022 gain was $143 million, a $3 million, or 2%, maximize from the first quarter of 2021.

The maximize in revenues was primarily thanks to a $36 million favorable effect from returned or repossessed devices, partially offset by a $29 million unfavorable impression from reduce ordinary funding charges.

Cat Financial states in the course of the first quarter of 2022, retail new organization volume was $2.78 billion, a lower of $30 million, or 1%, from the first quarter of 2021. The minimize was primarily pushed by reduced volume in Asia/Pacific and Europe, Africa and the Middle East partially offset by boosts in North America and Latin The united states.

At the conclude of the 1st quarter of 2022, past dues have been 2.05%, as opposed with 2.90% at the finish of the initially quarter of 2021 and 1.95% at the conclusion of 2021. The lessen in earlier dues was typically driven by the North The usa, Caterpillar Electricity Finance and EAME portfolios.

Produce-offs, internet of recoveries, have been $8 million for the first quarter of 2022, as opposed with $24 million for the initially quarter of 2021. As of March 31, 2022, the allowance for credit rating losses totaled $357 million, or 1.29% of finance receivables, in contrast with $337 million, or 1.22% of finance receivables at December 31, 2021. The enhance in allowance for credit score losses included a greater reserve for the Russia and Ukraine portfolios.

“The Cat Fiscal group proceeds to concentrate on execution of our method and supporting our prospects with fiscal providers solutions,” explained Dave Walton, president of Cat Economical. “With powerful portfolio health and fitness, we carry on to produce stable operational final results.”

[ad_2]

Supply website link