Alexandria Serious Estate Equities, Inc. Just Skipped Earnings – But Analysts Have Up to date Their Models

Alexandria Actual Estate Equities, Inc. (NYSE:ARE) shareholders are likely sensation a small unhappy, because its shares fell 5.% to US$152 in the 7 days just after its hottest quarterly effects. Income came in at US$545m, beating anticipations by a impressive 21%, while statutory earnings for every share (EPS) were being US$.63, missing estimates by an similarly extraordinary 29%. Pursuing the end result, the analysts have current their earnings design, and it would be great to know irrespective of whether they consider there is certainly been a powerful improve in the firm’s prospective clients, or if it’s business enterprise as usual. We considered viewers would discover it exciting to see the analysts most up-to-date (statutory) submit-earnings forecasts for next yr.

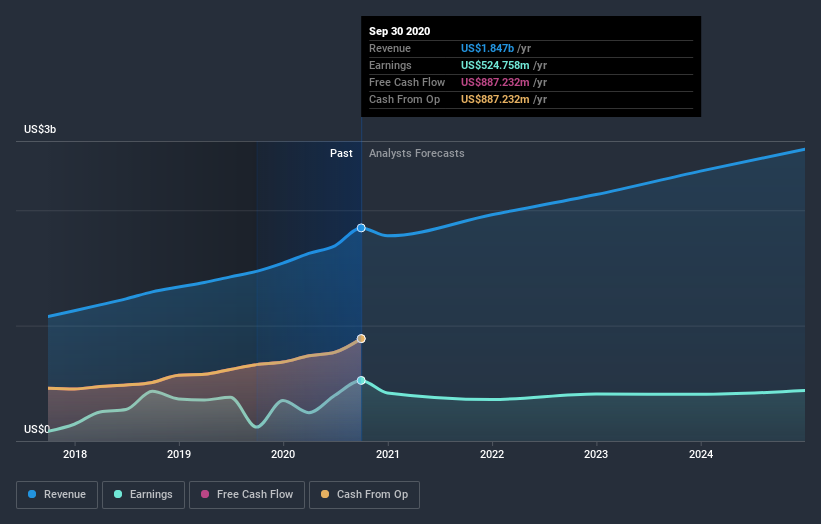

Having into account the most recent success, the current consensus from Alexandria Genuine Estate Equities’ seven analysts is for revenues of US$1.96b in 2021, which would mirror an okay 6.2% raise on its sales about the previous 12 months. Statutory earnings for every share are forecast to crater 33% to US$2.91 in the identical time period. Yet prior to the latest earnings, the analysts experienced been anticipated revenues of US$1.97b and earnings for each share (EPS) of US$2.69 in 2021. The analysts appears to be to have grow to be additional bullish on the small business, judging by their new earnings for each share estimates.

You will find been no key adjustments to the consensus price tag goal of US$184, suggesting that the improved earnings for each share outlook is not plenty of to have a extended-phrase good effects on the stock’s valuation. There’s a different way to assume about price targets nevertheless, and that is to glimpse at the array of selling price targets place ahead by analysts, due to the fact a broad variety of estimates could counsel a various view on probable outcomes for the company. The most optimistic Alexandria Actual Estate Equities analyst has a value focus on of US$204 for each share, even though the most pessimistic values it at US$165. Continue to, with this kind of a limited assortment of estimates, it suggeststhe analysts have a pretty great notion of what they think the firm is well worth.

One particular way to get far more context on these forecasts is to glance at how they compare to both of those previous effectiveness, and how other providers in the identical field are undertaking. We would spotlight that Alexandria Serious Estate Equities’ revenue development is predicted to slow, with forecast 6.2% boost upcoming year effectively down below the historical 16%p.a. expansion more than the past five several years. Examine this to the 185 other providers in this field with analyst protection, which are forecast to grow their profits at 6.% for each calendar year. So it really is quite obvious that, even though Alexandria Serious Estate Equities’ income growth is anticipated to gradual, it’s envisioned to grow approximately in line with the industry.

The Base Line

The most significant detail in this article is that the analysts upgraded their earnings for every share estimates, suggesting that there has been a apparent improve in optimism to Alexandria Real Estate Equities adhering to these benefits. They also reconfirmed their income estimates, with the company predicted to mature at about the exact same amount as the broader sector. There was no actual change to the consensus value concentrate on, suggesting that the intrinsic benefit of the small business has not undergone any important improvements with the newest estimates.

With that in thoughts, we would not be as well fast to occur to a conclusion on Alexandria True Estate Equities. Extensive-time period earnings power is considerably extra vital than up coming year’s revenue. We have forecasts for Alexandria Real Estate Equities likely out to 2024, and you can see them no cost on our platform listed here.

And what about hazards? Each and every business has them, and we have noticed 4 warning signs for Alexandria Authentic Estate Equities (of which 2 are considerable!) you need to know about.

This article by Only Wall St is typical in nature. It does not constitute a advice to get or offer any stock, and does not choose account of your targets, or your fiscal situation. We aim to deliver you very long-term centered assessment driven by basic details. Be aware that our investigation may possibly not factor in the most up-to-date rate-sensitive company announcements or qualitative content. Simply just Wall St has no situation in any shares talked about.

Have feed-back on this article? Concerned about the content? Get in touch with us immediately. Alternatively, e mail [email protected].

The sights and opinions expressed herein are the views and viewpoints of the creator and do not automatically replicate those of Nasdaq, Inc.