9 Ways to Invest in Real Estate for Retirement

[ad_1]

Investing in real estate is 1 of the oldest sorts of investing and numerous folks look at it to be a protected financial investment in comparison to other much more volatile investments like stocks. This is simply because classic genuine estate investing, or buying rental attributes, offers additional security than the inventory sector does.

Thanks – Owing

When you get a home or condominium constructing as a rental home, you you should not have to be concerned about the price heading up and down each and every day.

Rather, you can anticipate that your money will grow steadily around time as long as you keep investing in attributes that offer money circulation and enjoy in value. Though there are a lot of techniques to invest in real estate, this posting will concentration on how you can get began by acquiring single loved ones houses or industrial structures for your self.

Spend in home that you by now individual

It is hard to beat the safety of your very own property, especially if you happen to be planning on being place for the long haul. Approximately 80% of senior citizens owned houses heading into 2022.

“When you very own a dwelling, it’s possible to shell out down your home finance loan personal debt and create fairness at the very same time—both of which are interesting retirement expense procedures,” states Cliff Auerswald, President of All Reverse Home loan. You can also hire out rooms or even transfer into a more compact rental house and lease out the relaxation of your house!

- Obtain a multi-household house or business constructing

If living in a single put is just not an solution for you correct now, think about investing in a multi-relatives dwelling or industrial developing exactly where other men and women will be having to pay lease though building your home finance loan payments for you each and every month (and perhaps even spending off some of its principal).

When this style of real estate may perhaps have to have a little bit much more upfront capital than single spouse and children properties do, there are usually tax positive aspects linked with possessing several homes as properly as enhanced likely for development in excess of time if completed appropriately!

Make investments in a REIT

A further way to spend in serious estate is by a REIT– It owns roughly $3.5 trillion in gross real estate belongings, with more than $2.5 trillion of that complete from public outlined and non-shown REITs and the remainder from privately held REITs. or actual estate expenditure trusts. REITs are firms that have earnings-generating true estate and then promote shares of on their own to buyers.

You can assume of investing in a REIT as a way to commit in actual estate without the need of really possessing any house oneself. These entities are traded on inventory exchanges like any other publicly traded company, which means you get some liquidity—and hopefully, superior returns—compared with acquiring and selling unique attributes.

Devote for hard cash circulation

Dollars stream is the sum of dollars you receive from hire and other income. It’s a essential indicator of regardless of whether or not a assets is a fantastic financial investment, because it demonstrates how nicely a residence is generating profits. If the cash flow is not there, you may well not be able to manage mortgage payments and upkeep charges.

Although lots of buyers aim on home-rate appreciation—how considerably their home has improved in value considering the fact that they purchased it—you ought to think about cash flow as your primary issue when choosing irrespective of whether or not to get real estate for retirement.

Your aim is to have ample revenue left about right after shelling out all your costs that you can are living easily without the need of acquiring to get the job done once again!

Flip homes for gain

Flipping qualities is a risky proposition that can be a very good method when the marketplace is scorching. The flip requires buying a property, fixing it up and then advertising it at a income. “If you are willing and capable to get on some chance, this strategy can fork out off major,” states Kevin Bazazzadeh, Founder of Amazing Day Houses.

There are challenges concerned with flipping houses for the reason that you have no warranty that you’ll make dollars just after all your expenditures (including renovations) have been compensated for.

Even if the true estate market has bottomed out and is about to switch around, there are no assures that your house will promote for extra than what you bought it for—or even address what you’ve invested on repairs.

Order a getaway rental property

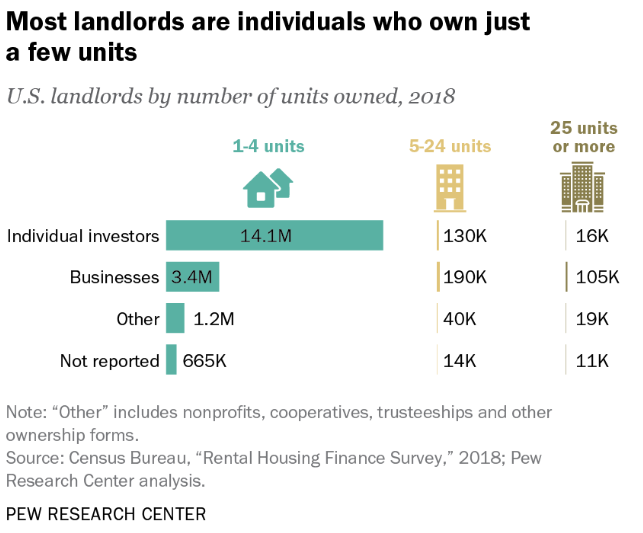

When it will come to investing, the very best sorts of qualities are individuals that can generate passive income. This means you can obtain and lease out the assets with no obtaining to regulate it whole-time. Unique authentic estate buyers account for 72.5% of rental properties in the United States.

Getaway rental homes in shape this requirements flawlessly. You’ll be equipped to use your financial investment as a secondary earnings stream, offsetting the expenditures of possession with rental payments. And if you are not comfy handling tenants or dealing with servicing concerns, you can find constantly Airbnb!

According to Alan More difficult, a Vancouver home finance loan broker, “the essential listed here is to make confident you choose a family vacation rental property that has an established industry and need for rentals in get for it to be lucrative for both you and any opportunity tenants – that way, no a single loses out.”

Devote in a lengthy-expression rental property

- Come across a home. Whether you might be looking for an condominium developing or a home, you want to locate a site that is increasing and has very good probable for rental revenue.

- Calculate the ROI (Return on Financial investment). There are lots of variables that go into calculating the ROI of your property—the quantity of bedrooms, selling price for every square foot, and so on., but one particular matter continues to be consistent:

- Your monthly lease really should cover all fees and then some far more every thirty day period in order for it to be an investment worth pursuing.

- Uncover a tenant who will fork out on time every month without having are unsuccessful! This can be challenging if you never have prior working experience performing this sort of factor oneself (or if you happen to be just setting up out),

- so it could possibly be smart to hire a home administration business that can aid with this action when also fixing any other problems that may perhaps occur just after going tenants in or out of the dwelling/apartment making itself above time as perfectly as controlling repairs

Buy and convert business office place to household units

Changing workplace space to household models is a great investment for retirees. A person of the major causes for this is that underutilized offices are usually situated in fantastic spots, and they’re more cost-effective than residential attributes.

Also, converting workplace room to household units means that you can get additional use out of the house by providing it with more benefit.

This is specifically accurate if you live near an place wherever there aren’t many spots for men and women to lease or get households but require them in any case since they function in a nearby city center or company district all through weekdays but really don’t like being at accommodations on weekends.

Acquire a multi-relatives dwelling and stay in just one unit even though renting the other folks out.

If you are wanting to invest in a multi-family dwelling, there are a couple of matters to contemplate.

- You can dwell in one particular unit and lease out the some others. “This is a wonderful way to gain passive earnings as you may be amassing lease payments from tenants when you reside in your possess house,” notes Rinal Patel, a Accredited Realtor and Co-Founder of We Acquire Philly Property.

- You could also make your mind up to obtain a multi-loved ones property and rent all of the models, leaving yours empty until it gets obtainable. In this circumstance, you would want obtain to another supply of income that will fork out for your home finance loan although waiting around for renters who want to move into their new homes—and likely give back again some of that income when they leave!

Spouse with a different investor on a deal (or two or three)

If you might be not an expert, it can be tough to know how much to pay out for a residence and how to obtain great bargains. A person way to mitigate the risk is by partnering with other investors on a offer (or two or a few).

With extra people involved in the purchase, there are extra eyes on each individual phase of the approach and extra people who can assist make choices about which attributes are value pursuing.

If you’re looking for somebody to partner with, your ideal bets involve on the web platforms like RealtyShares and Fundrise that allow for buyers from across the planet entry each others’ listings.

If that isn’t going to get the job done out, consider inquiring pals or household associates if they’d be intrigued in acquiring involved in real estate collectively — chances are they’re going to be delighted for your help! There are also nearby meetups specifically designed for obtaining trader partners just look for on line for “true estate investing meetup” around you.

There are numerous techniques to commit in actual estate, which include things like buying residences and industrial buildings, putting revenue into other people’s investments and borrowing to make investments in rental properties.

- Buy a property

- Make investments in a REIT (true estate financial commitment rely on)

- Commit for dollars circulation

- Flip attributes for revenue

Summary

If you’re on the lookout for a way to generate money or profits in the course of retirement, then serious estate may well be the right choice for you. There are numerous different types of investments that can assistance you fulfill your aims. The ideal way to make your mind up which one particular will get the job done finest is by undertaking study on each individual form before creating any decisions.

I hope this post has presented some insight into the techniques in which retirees may well invest in serious estate.

The put up 9 Ways to Devote in Genuine Estate for Retirement appeared very first on Due.

[ad_2]

Source website link