4 Essential 1031 Exchange Strategies To Use in a Seller’s Market

[ad_1]

If you have not observed, there truly hasn’t been a superior time to provide a house.

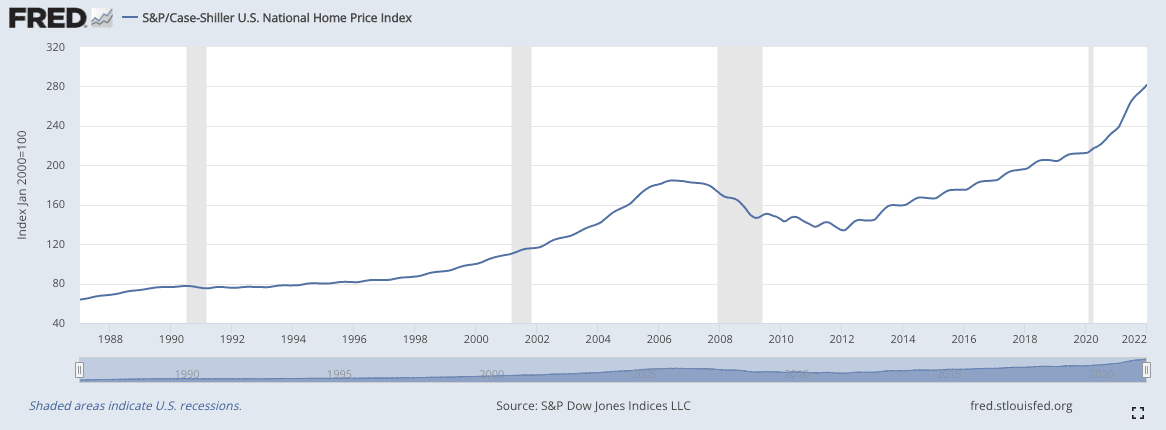

The Case-Shiller Index rounds out to about 282 details as of late January, and median household prices rose 15.9% year-over-calendar year in February.

Insert in the point that sellers are acquiring multiple presents within just a couple times after listing and you have all the ideal components to start off a bidding war, boost the price of your home, and walk absent with far more than you could picture.

But, there is an situation. Taxes.

It is excellent seeing the selling price tag of your home improve, but that also means your tax monthly bill will be significantly larger. If you want to take edge of the appreciation your present expense has acquired but do not want to get strike with the corresponding tax bill you may possibly want to take into consideration some of these 1031 exchange strategies the top buyers are making use of to navigate the seller’s sector.

Why use a 1031 exchange?

With a 1031 trade, you can shelter your gains from being taxed by subsequent up the sale with an additional actual estate expenditure of equivalent or larger value. If you observe the principles established by the IRS, your real estate investments can improve tax-deferred.

The challenge of working with a 1031 trade in a seller’s industry

These days, the most difficult element of executing a 1031 exchange is acquiring the alternative residence within just 45 days of closing the sale on the previous property.

As we talked about previously, sellers are savoring the luxurious of bidding wars and sky-significant charges. Investing in today’s marketplace is a lot extra hard. Specials are challenging to uncover, and you simply cannot ensure that the assets you want will fall into your fingers.

The superior news is that after discovered and placed under deal, the IRS grants an supplemental 135 times to finalize the obtain ahead of the 1031 exchange is no for a longer time eligible.

1031 exchange tactics

The best way to execute these 1031 trade methods is to have a approach just before the assets you’re offering is put below deal. It’s the time of closing that determines 1031 trade eligibility, so you will have to have to know your readily available routes prior to this date.

You really don’t will need to have the ball rolling on a next house while your present-day is beneath deal. Not all people is relaxed heading following the substitution property before their first sale closes—even with contingencies. Make positive to decide your hazard tolerance and only take action that allows you rest at night.

The 4 1031 trade methods we’re going to talk about are centered on exactly where you are now at in the sales timeline. Those are:

- If you have not shown your home nonetheless

- If you are previously under contract

- If you’ve now shut

- Use a reverse exchange

Dreading tax time?

Not sure how to optimize deductions for your real estate small business? In The E-book on Tax Methods for the Savvy Actual Estate Trader, CPAs Amanda Han and Matthew MacFarland share the useful details you will need to not only do your taxes this year—but to also put together an ongoing technique that will make your next tax year that significantly less difficult.

If you have not outlined your assets nevertheless

The very first strategy is to negotiate the closing of your sale in a way that retains you in the driver’s seat. If you can discover a welcoming purchaser, this is the simplest way to do a 1031 exchange.

A purchaser inclined to wait for you to conclude your property research is the greatest-circumstance circumstance, but if you simply cannot uncover another person eager to wait around, you want to analysis a few matters.

First, discover knowledge on your marketplace and look at the regular times on industry (DOM). This amount will allow you know how extensive you have to discover a further home or even the leverage you have over selling your personal.

You can source this information by Zillow, Redfin, or Real estate agent.com. Or, get in contact with a reliable neighborhood serious estate agent in your area who can give highly precise facts working with the several listing service (MLS).

You could also request other genuine estate buyers what their previous thirty day period has seemed like in your spot.

Primarily based on what you discover out, listed here are the adhering to solutions you have:

- Delaying putting your residence on the sector till just after you come across a replacement.

- Negotiate an prolonged sale day with the solution to speed up.

- Increase a contingency clause to the offer that makes the sale dependent on you acquiring a suited replacement inside of a certain amount of time.

- Increase the selection to increase closing by 15-30 days or far more.

If you’re now below deal

If you are by now less than deal to market your property, you can nonetheless acquire action to satisfy your 45-working day identification deadline.

The goal is to begin making features as before long as achievable. The problem in a seller’s current market is that potential buyers have little to no leverage. If you simply cannot meet up with the seller’s terms, they can basically select a different provide. So you will have to be wise.

You have a few paths to get below:

- Think about producing offers contingent on your sale (the odds of this functioning is incredibly minimal in a seller’s market place, but it’s truly worth making an attempt on a few of homes).

- Check with for an extended closing (I recommend two months soon after your sale is scheduled. Some of our investors are experiencing loan provider delays on their revenue that disrupt restricted closings).

- Try to get an inspection, because of diligence, or financing clause that expires a week or two soon after your sale is scheduled to close.

- Consider a tiered earnest income offer to get a single of the over methods to work. Exclusively, provide a stable earnest dollars deposit at signing with one more bigger earnest funds deposit following your sale closes. Make these refundable or non-refundable depending on your threat tolerance and what the scenario warrants.

If you’ve previously closed the sale

This isn’t the very best state of affairs to be in, but not all hope is misplaced. Remember, you nonetheless have 45 days submit-closing to locate a alternative residence to execute a 1031 exchange.

But, you have to have to be quick and productive in seeking for new attributes.

If you have exhausted your choices and spoken to each individual connection you have who might know about a new deal coming to market, from the nearby agent to the plumber who always fixes the leaky taps, you may possibly want to look at increasing your variety.

The initial point is to contemplate dipping into markets outside of your very own. If you have not been now, you might also want to appear at attributes that you could possibly not normally invest in.

For occasion, if you’re a brief-term rental investor but cannot snag a deal, possibly you need to dip into the multifamily market?

Last but not least, probably it is time to glimpse into fractional house ownership buildings like a Delaware Statutory Have faith in or a syndicated tenant in widespread challenge. When completed correct, these kinds of investments can demonstrate to be profitable and supply a 1031 trade outlet.

Use a reverse exchange

If you have identified the great substitute residence but can not get the sale of your authentic assets lined up in advance, a “reverse” trade may perhaps be a very good fit.

A reverse trade is a much more sophisticated trade structure with a longer lead time, exclusive funding necessities, and a higher value tag. That currently being mentioned, if you identify a wonderful opportunity, the trade will defer a important volume of tax.

A reverse trade makes perception in a seller’s market as warm as the just one we’re in now if you can pull it off.

Closing feelings

Although definitely not the preferred choice, it is critical to emphasize that there is no penalty for starting a 1031 trade and not finishing it.

If you are not able to come across a acceptable substitute, it would be superior to allow your exchange die and pay out the taxes alternatively than make a poor investment. In the very long run, you’ll regret the negative financial commitment additional.

If you have any other 1031 trade tactics, leave a remark down below to share them with the BiggerPockets neighborhood!

[ad_2]

Supply url